Fed up with being broke?

You must have seen the occasion in which a relative or friend shows up with his or her life turned over financially involving a new look, car, house, and a clean sheet regarding their debts. What was your reaction? Did you envy the guy or longed to be in their shoes and would kill for the details of how to go through the same experience?

In modern societies these days, financial issues have become an inevitable part of people’s lives that some have accepted it as a norm and are getting used to it unfortunately.

Global Economy Issues and Solutions

This applies to many cultures and societies since the economy of most countries hasn’t been in its best shape lately, or at least this is what is believed by the majority that generally speaking the economy of the world, especially developed ones even deteriorating by the day.

Consequently, the way forward for the lower or middle classes of society might be to go for either local or federal grants for their businesses in order to be able to make ends meet and keep their business thriving. In fact, there are many gifted people with innovative ideas who only need a financial push to go on track and shake the world. Alright, I am about to reveal the most effective approaches you have been waiting for, by which you will understand how to look for and receive small business grants in the US regardless of the timeline you’re in.

What exactly is a grant?

A grant is some money that is given to an organization, firm, company, business owner, or in some cases to a person for specific purposes Broadly speaking, we have two types of grants in the US for small businesses that either stem from Governments and Organizations, These other non-profit organizations are assigned to distribute the considerable amount of funds given to them by the government to the most eligible or suitable candidates.

What are the differences between a grant and a loan?

It goes without saying that a loan must be returned in a specified certain amount of time. Nonetheless, there is no need for a refund in the grant cases since that form of the budget is in fact allocated to such needs. In the bigger picture, it is assisting the economy of the country to thrive and improve is one of the main concerns among authorities.

How to receive the grant?

I believe it would be much easier if you start with your local city, after that if the needs are not met you can always broaden the scope and go for the local government, again, since it is local there is less competition involved and more likelihood for you to receive the grant you seek.

- Local Small Business Development Center

- Local Economic Development Authority

- Call your elected officials’ offices directly to provide you with the money

Small Business Development Centers

SBDCs are the organizations that have been specifically assigned by the state to gauge and assess the requests from different firms and companies and give the allocated sums of money names as grants to those who they see fit in order to help develop and improve the economy of the country or that state and hence the well-being of the whole community.

Small Business Administrations

The Small Business Administration is a free U.S. government agency that bolsters, advances and speaks to small businesses within the U.S. The SBA was built up in 1953 to serve as a basic asset for business visionaries and existing small business owners. The Small Business Administration provides financial assistance in terms of grant opportunities and loan programs to small businesses, hence providing diverse means of support for financial problems and meeting pre-set goals or targets.

In cases of starting a new venture or expanding the existing operations, it would be much more likely to be considered by the SBA to receive grants.

The Small Business Administration is an independent agency of the US government that aims to provide support to, promote, and protect small businesses in the country. The SBA was established in 1953 to act as the primary resource for entrepreneurs and existing small owners in areas such as:

Financial Assistance SBA offers numerous grant and loan programs to help surmount financial hurdles and meet business objectives.

Some such ways of use include:

- Starting a new business Expanding existing operations

- Purchase equipment or real estate

- Recover from disaster

- Counseling and Mentorship

The SBA introduces you to counseling and mentorship programs that match small business owners with the experience of professionals who render productive advice on various business procedures.

Business Development Resources

The SBA maintains numerous online resources and informational sheets that provide the small business entrepreneur with knowledge and expertise to better position oneself to succeed in business.

Examples of SBA Grant Programs:

Small Business Innovation Research:

It is a program that funds many diverse types of research and development activities by small businesses on behalf of the federal government.

State Trade Expansion Program:

STEP provides grants for helping small businesses looking to expand their exporting activities.

Community Development Block Grant: The program provides grants to states and local governments; some of which are again utilized to orderly fund reasons of small business development in communities.

Equipment Purchasing or Real Estate

Disaster Recovery

Counseling and Mentorship:

SBA provides access to counseling and mentorship programs that match small business owners with experienced professionals who can offer them worthwhile guidance and support on many diverse business issues.

Business Development Resources:

SBA grants independent business enterprises a multitude of online resources and educational materials to gain the knowledge and tools to be successful.

Examples of SBA Grant Programs:

Small Business Innovation Research Program (SBIR): It helps small businesses in research and development efforts dedicated to the interest of the federal government.

State Trade Expansion Program: Provides grants to develop export activities of small businesses.

Community Development Block Grant: This would provide grants to state and local governments; some of these monies can be used for small business development initiatives of interest to the community.

Local SBDCs

Among the many SBDCs located all over the United States, he/she will have no problem finding organizations ready to consult on business issues for free or providing training at low costs and other resources to help people along the way to becoming successful entrepreneurs or small businesspeople.

You can find your SBDC by visiting the Association of Small Business Development Centers website at asbdc.org. You can then use their “Find Your Local SBDC” tool to type in your state or perhaps your zip code to see the SBDC closest to where you may be. For the most part, they’re affiliated with any university or college.

You will get highly diversified services: business planning, market research, funding options—the list is endless. They also link one to other resources and networking opportunities that will help develop your business.

The following are some of the famous websites where one can find and apply for grants in America.

Grants.gov: It is a resource that offers resources for all the potential variety of grants the federal government holds, such as to small businesses, non-profits, and individuals.

SBIR—Small Business Innovation Research Program, and STTR—Small Business Technology Transfer Program: They give them in small businesses and research faculties to invent and make technical breakthroughs.

NIH Grants: These are, more or less, research and development of health and medicine in different forms.

Small Business Administration Grants: At its disposal, SBA runs different types of grant funding, like STEP and SBDC.

Foundation Directory Online: This, too, is a directory of private foundations that grant monies to nonprofits and small businesses.

Community Foundation Locator This site allows you to search for community foundations around the United States that support local organizations.

Fast-lane They scour for where entrepreneurs could secure funds, be it through a grant, a loan, or an investment.

Local Government Agencies This may encompass the following: City or county government Websites Chamber of Commerce websites Economic development agencies Nonprofit organizations. You can also perform a search online by using keywords such as “small business grants near me” or “grants for [specific industry/field].”.

As an example, we take a look at Atlanta SBDC and also ASBDC which can identically apply to other cities or states as well.

Atlanta Small Business Dev Center

Address: Georgia State University, Robinson College of Business 35 Broad St., Suite 340 Atlanta, GA 30303

Phone: (404) 651-9244

Email: [email protected]

The ASBDC provides no-cost consulting and low-cost training for the Atlanta area entrepreneur or small business owner. A variety of services are provided.

Detailed below are some:

- Business Planning and Strategy Develop a viable and effective business plan.

- Market and Feasibility: Identify the major competitors, potential customers, and risk levels before the market entry”

- Financial: Planning of annual capital and operating budget to consider the financial and budgeting requirements.

- Marketing/ Sales Strategy Development: A marketing and sales strategy primarily describes how the products of a business are going to

- Networking Reasons

ASBDC is the department that integrates the Georgia Small Business Development Center Network, which is the Georgia SBDC a network of the same centers strategically placed throughout Georgia.

Services:

- Business Planning: The ASBDC provides each entrepreneur or business owner with a specialized consultancy that applies to that firm or brand only, this could be a very interesting feature; project a marketing plan, financial projection, and general business plan.

- Workshops: Many educational programs are held and run in this center featuring marketing, finance, management, and entrepreneurship.

- Market Research: In order to aid businesses in understanding their target market and the competition involved, data analysis and market research reports are provided by ASBDC.

- Financial Analysis: Budgeting, forecasting, and cash flow management, the key elements about which financial analysis and planning is carried out by this department.

- Funding Access: The ASBDC takes away the concern for financial resources in entrepreneurs’ mind so that they can solely focus on their objectives. This amazing purpose is conducted through grants, loans, etc.

- Networking: Chances tatted for an entrepreneur to network with other business owners, mentors, and key people within the industry.

Target Market:

- Small Business Owners: Targeting small business owners

- Entrepreneurs: The target for the center would include entrepreneurs qui are planning to start or expand on a new business idea.

Non-Profit Organizations: The ASBDC also assists non-profit organizations that need assistance through business planning, funding and carriable operations.

Eligibility:

- Business Locality: Atlanta metropolitan area, being made up of Fulton, DeKalb, Clayton, Cobb, Gwinnett and Cherokee counties

- Funding Options:

- Grants: The ASBDC helps a great number of small businesses access all grant programs, including government grants, foundation grants, and corporate grants, among many others.

- Loans: ASBDC can help the entrepreneur secure small business loans among local lenders – both banks, credit unions, and alternative lenders

Investors: ASBDC can network the entrepreneur with any form of investor—be it an angel investor, a venture capitalist, or any other form of investor.

- Other Resources

- Online Resources: ASBDC has an abundance of online resources in the form of a webinar, article, and tutorial, covering all sorts of subjects related to business.

- Mentor Network: It also offers an experienced mentor network for the proper guidance and support of the entrepreneur.

The ASBDC links strategic partnerships with other institutions, like the Small Business Administration, the Georgia Department of Economic Development, and several local government agencies, to drive home additional resources and services in serving entrepreneurs.

The Atlanta Small Business Development Center is a real jewel that assists entrepreneurs in finding help within the Atlanta area for starting or growing a business.

- Submit your request on the website or Call the local directory directly:

I would personally recommend calling them directly since they are already there to help you and there is no shame in calling them. In this form, you get a better grasp of the situation and how things will shape your own case. However, you can also submit your case online on the proper platform. In either case, the mentioned resources are very likely to meet the needs of your business and needs.

Contacting Local Economy Authorities

These may involve the following local economy authorities in the United States, though they may vary from city to city or state to state.

- Local Economic Development Corporations (LEDCs): These are oriented public or private non-profit economic development corporations in a bid to create jobs and retain businesses.

- Chamber of Commerce: With an aim to help the local economy blossom, there exists in every Chamber of Commerce the economic development committee whose sole purpose would be to assist businesses within the region so as to help them grow and prosper to raise the overall economy of the area.

- Economic Development Agencies: Such agencies are normally sub-elements of local governments tasked with attracting new business as well as supporting existing business ventures with the motive of creating jobs within their precincts.

- Port Authorities: The port authorities manage, operate, and develop the ports that have normally turned into gigantic engines for their regional economies.

- Tourism Boards: Most cities and states have tourism boards that invite visitors. The function of these boards includes the encouragement of local attractions and activities to help spur the economy locally.

- Airport Authorities: The authorities that govern airports work on increasing traffic through the addition of airlines and passengers, adding support to regional economic development.

- Downtown Development Authorities: With the vision of enhancing local businesses and the quality of life, downtown development authorities are eager to go to great lengths to pave the ground for the renewal and prosperity of the downtown.

- Main Street Programs: Such programs are aimed at facilitating the renewal and preservation of the character of downtown commercial districts through business support, community participation, and economic development. It falls under the purview of the city/county government. The local government could have special departments or offices responsible for economic development, zoning, and business permits.

Generally, SBDCs are located on a university or college campus and offer free business consulting, low-cost training, and other resources to small business owners and entrepreneurs in their communities.

Some notable examples of the Local Economy Authorities in the US are:

- Office of Economic and Workforce Development – San Francisco

- Department of Business Affairs and Consumer Protection, Chicago

- New York City Economic Development Corporation, NYCEDC

- Department of Commerce, State of Washington

- Economic Development Department, Austin

- Office of Economic Development, Dallas

The list of authorities within the area of Local Economy Authorities continues like this all over the US, where the entities have different focuses and responsibilities.

Creating Job Opportunities

One of the main reasons that governments or federal agencies allocate specific amounts of money annually for grants and business loans is the fact that by doing this the production rate of the country increases, from another point of view, apart from the economy being activated again, a form of cycle is initiated in which new jobs are created by the firms or companies which receive the grant and through that unemployed people can find a good job and be able to provide for their family.

Consequently, each would become much more capable of purchasing and spending their salary in the market and the local economy leading to a more active community financially speaking. Also bear in mind, they love businesses to come to them.

Federal businesses, much like government agencies and organizations, are fond of people coming to them for grants because it serves them in the following ways:

- Helping in Economic Development: Grants give a push to economic growth and development within a community, which is one of the prime objectives for most federal agencies. Grants for funding research and development projects that can result in innovative products, services, or processes help benefit society at large.

- Job Creation: Grants also work towards creating and sustaining jobs, one characteristic of economic development that most federal agencies focus on.

- Improved Infrastructure: Grants would also serve to upgrade the infrastructural setup, be it transport facilities, public facilities, or even community buildings, thereby benefiting both the local community as well as the federal government.

- Foster Community Engagement: Grants can support community-level projects interested in social cohesion, community engagement, and civic participation, aligning with the goals of the federal government in building strong, resilient communities.

- Demonstrate Public-Private Partnerships: Grants can establish a collaboration between federal agencies private businesses and non-governmental organizations, working collaboratively and leveraging resources.

- Match or leverage funding: Grants may be utilized as a match or leveraging of funds to any other source of funds, including private investments or philanthropic donations. This will have a greater impact than the grant would attain by itself.

- Build capacity: Grants can serve to build the capacity within organizations in order to enhance their ability to deliver services, carry out projects, or provide resources to the community.

Grants can be utilized toward projects that promote sustainability and the preservation of the environment and may achieve climate resilience, one of the objectives of the federal government.

- Federal Presence: Through grants, federal agencies can make a presence felt and known in a specific region or community to build reputation and relations with the public.

In this way, through the granting process, federal businesses will not only work toward achieving these goals but will contribute toward developing the economic and innovative capacity of a community.

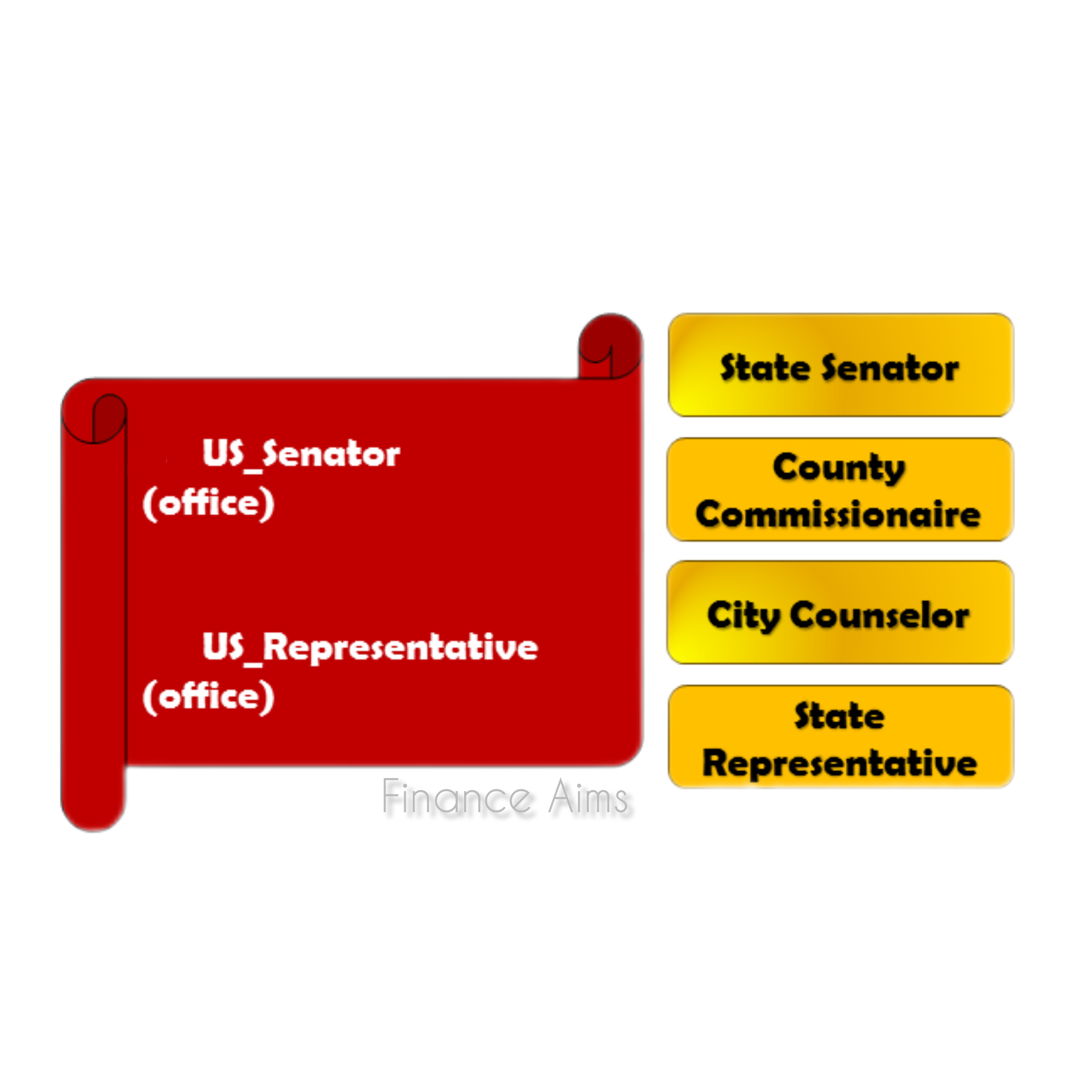

Calling your elected official or his/her office

By doing so you can directly get first-hand guidance regarding where you should go and what needs to be done.

How to locate your elected official:

- Looking on your voter registration card or driver’s license—much of it is printed on these.

- Looking online: US Senators: senate.gov; enter in your state and zip code. US Representatives: house.gov; enter in your zip code.

- State Senators and Representatives: usa.gov/elected-officials; enter state and zip code and search.

- Contact your local government office: You can visit your county, city, or township’s website and conduct an online search regarding the listed elected officials.

After you find their contact information, you will be in a position to solicit them for assistance on the following:

- Grant opportunities: Ask about federal, state, or local grant opportunities within your district.

- Entrepreneurial writing: Ask for help with writing a grant proposal.

- Community development projects: Discuss local projects or initiatives they may be sponsoring and how you might get involved.

Some elected officials who can assist you in seeking grant money are, for example:

When you contact your elected officials, be ready to share details about your project or plans for the funding.

This includes information on the following:

Project description

Budget requirements

Timeline

Expected outcomes/ impact

The other option you have is to go to the website, www.openstate.org, after entering your zip code then you will be able to find the elected official. After you specify the official you can call them.

Introduce yourself as a business owner, do not be shy, and make sure you state your request firmly and strongly. They would certainly consider your request and do whatever there is in their power to assist you. If your business takes off, it would lift their resume and professional background as well.

You can always turn to ECCOs for financial aid in your business, ECCO is a nonprofit organization that has committed its resources to providing small businesses, particularly those located in low-income communities, with adequate financial and operational support to grow and effectively service the respective community, thus economical developing it.

ECCO focuses on:

Financial Support: ECCO helps small businesses access capital in terms of loans, grants, and equity investments to jump over financial hurdles.

Business Development: Ecco trained, mentored, and coached on how to develop business skills, especially in marketing, operations, and basic financial management.

Capacity Building: Ecco works with any willing, market-ready business and enhances their capacity with the use of appropriate resources, whether it be technology, equipment, or supply chain management.

Advocacy: Ecco impacts policies and programs securing sustainable growth and development for small businesses across low-income communities.

Ecco targets:

- Low-income entrepreneurs: These could be those from a low-income background, wanting to start or grow a business.

- Minority-owned businesses: These are businesses whose ownership is vested in underrepresented groups, such as women, minorities, and veterans.

- Community-based organizations: They are non-profit, serving low-income communities as vehicles to channel services such as training, education, and health.

- Small businesses in underserved areas: These are small businesses whose respective areas of operation have limited resources, such as rural or inner-city areas.

Some of these services include business planning, access to capital, marketing and branding, training and mentorship, access to networking opportunities, technology and equipment, supply chain management, advocacy and policy support. With these services, ECCO aims to create economic opportunities for low-income people at both individual and community levels and ensures sustainable development with the reduction of poverty.

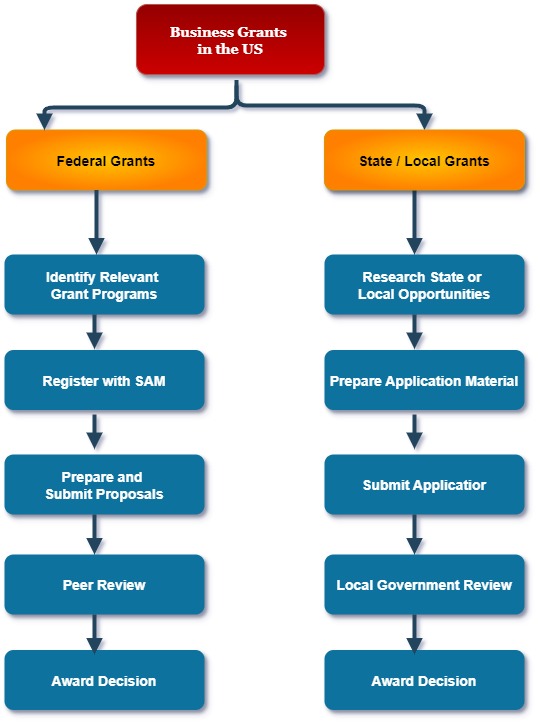

Federal Grant or State Grant? That is the Question!

It is about time to go over the differences between the State Grants and the Federal Grants.

There are some main differences between Federal grants and State grants. Nonetheless, both are committed to aid small businesses thrive in the community, especially after the covid. Some of the main differences are presented below:

Financial Source:

- Federal Grants: The money is directly taken from the federal government and governed by the White House and Congress.

- State Grants: The state government is the provider in this case, which is managed by the state legislature and governor.

Eligibility:

Federal Grants: Most federal grants are open to anyone whose application meets the eligibility criteria; these can be non-profit organizations, universities, businesses, or individuals.

State Grants: State grants may have even more specific eligibility requirements, like only being available to state residents and businesses operating in the state, or perhaps to organizations with some sort of particular mission or focus.

Purpose:

Federal Grants: Federal grants often have broad purposes, like providing for economic development, education, healthcare, or infrastructure projects.

State Grants: State grants may be more specifically aimed at supporting local businesses, community development projects, or state-particular initiatives. Funding Amount: Federal Grants: Federal grants can range from small to millions of dollars. State Grants: Although state grants are smaller in amount as compared to federal grants, these still can pare up to become very large funding for a local project.

Application Process:

Federal Grants: Most federal grant applications need much more effort, with proposals, reviews, and evaluations.

State Grants: Applications for state grants would not be so complicated and might be less troublesome.

Matching Requirements:

Federal Grants: Federal grants typically require matching funds to be available from the applicant or other sources.

State Grants: Whilst state grants do not generally require one to provide matching funds, some may require a given percentage of the whole project cost to be funded by the applicant or other sources.

Repayment Terms:

Federal Grants: Federal grants generally provide the terms for repayment when necessary, including, for example, repayment time frames or forgiveness.

State Grants: State grants might also give the same in relation to their basis, but, again, these vary from state to state.

Oversight:

Federal Grants: Federal grants are subject to federal oversight and auditing requirements.

State Grants: State grants are also prone to state oversight and audit requirements. In sum, while projects or activities may be aided by federal and state grants, there are differences in terms of the source of funding, eligibility, purpose, amount of funding, application and review process, matching, repayment, and oversight.

A State Department of Economic Development

A State Department of Economic Development is a government agency responsible for promoting and developing a state or regional economic growth and prosperity. Specific responsibilities of the DED vary from state to state, but common functions include business attraction and retention. For example, it might provide a number of incentives, such as tax breaks grants, or even low-interest loans, to attract new businesses within the state while attempting to retain existing ones.

- Business Development: This would include the DED’s support to small businesses, startups, and entrepreneurs through business acumen training programs, mentorship, and access to capital.

- Workforce Development: DED can partner with education institutions and private training providers to develop an able workforce as required by the local industries.

- Infrastructure Development: The DED will also invest in infrastructure projects such as roads, bridges, and public transport, which would mean access and connectivity.

- State tourism promotion: DED could promote tourism in the state by implementing marketing campaigns, events, and attractions.

- Foreign trade: The DED could connect international markets by promoting export-oriented business linkages along with establishing trade missions where more substantial trade volume prospects exist, and negotiating trade agreements.

- Policy-making: In this regard, the DED may formulate policies to make support for growth operational—some of which might concern tax reform, regulatory streamlining, and workforce development activities.

The DED can moderate and analyze data regarding the state’s economy to establish trends, opportunities, and challenges. Some of the typical programs and services of State DED include:

Business loan programs

- Tax incentives

- Small business/startup grant programs

- Workforce training programs

- Trade missions/international trade assistance

- Tourism marketing campaigns

- Business retention programs

- Entrepreneurship support service

Examples of State Departments of Economic Development:

California Governor’s Office of Business and Economic Development

Texas Economic Development Corporation TEDC

New York State Empire State Development ESD

Michigan Economic Development Corporation MEDC

Illinois Department of Commerce and Economic Opportunity DCEO

Specific duties and programs are left up to a given State DED, as all vary based on the priorities and goals set for economic development in a state.

Despite the name and the image in citizens’ minds, some types of loans also could work as well as grants for small or newly founded businesses and brands such as:

SBA (Small Business Administration) Loans:

Attractive Interest Rates: The interest rate is very competitive and most often lower than what most conventional lenders quote.

Flexibility in Repayment: The loan can stipulate repayment terms extending to longer periods, thus allowing the small business ample time to repay the borrowed amount.

Bigger Loans: Compared with other types of small business loans, SBA loans have the potential for larger loan amounts.

The SBA streamlines the application process through which one can avail of the loan. It is a government-backed loan, so compared to other regular loans, SBA loans can be more secure for the lenders and easier to qualify for by small businesses.

PPP Loans (Paycheck Protection Program):

Forgiveness program: It is, in real sense, one of those unique characteristics of PPP loans where a certain amount of the loan can be forgiven if spent on qualified expenses such as payroll and rent.

Low-interest rate: PPP loans charge only 1 percent as interest, which is very low compared to most other forms of business loans.

Flexibility: The way in which this loan can be spent upon quite a few items associated with the expenditures of any business concern, ranging from employee salaries to the paying of rent, is flexibility itself.

Urgent funding: PPP loans are such that they provide fast funding to small businesses that have been hit hard by the COVID-19 pandemic.

EIDL Loans (Economic Injury Disaster Loan):

Longer repayment terms: EIDL loans are granted for a longer period than most of the other forms of small business loans, usually up to 30 years.

Lower interest rates: EIDL loans charge lower interest rates compared to other types of small business loans.

Fund flexibility: EIDL loans are free to use for working capital purposes, inventory, purchases of equipment, and other general approved business expenses.

Disaster relief: The contents material in this EIDL loan fund is the rebuilding process of small businesses torn apart by natural disasters and downturns in the economy.

In sum, these government-backed loans offer small businesses some few benefits in terms of low interest rates and fees, easy repayment terms, a large loan amount, easy applications, government security, forgiveness programs, and state of emergency funding.

Make sure you do these things before applying for grants,

- Your business is incorporated into an entity

- Your business and personal taxes should be completed

- Your business books should be up to date

I hope this article be of assistance to those seeking the capital to realize their lifelong dream.